Now ranked among the top three most investable asset classes for 2025 (PwC-ULI report), student housing is attracting increasing institutional interest. While the number of companies has surged, demand continues to outpace supply, ensuring sustained growth opportunities.

Source: BONARD Student Housing Annual Report 2024.

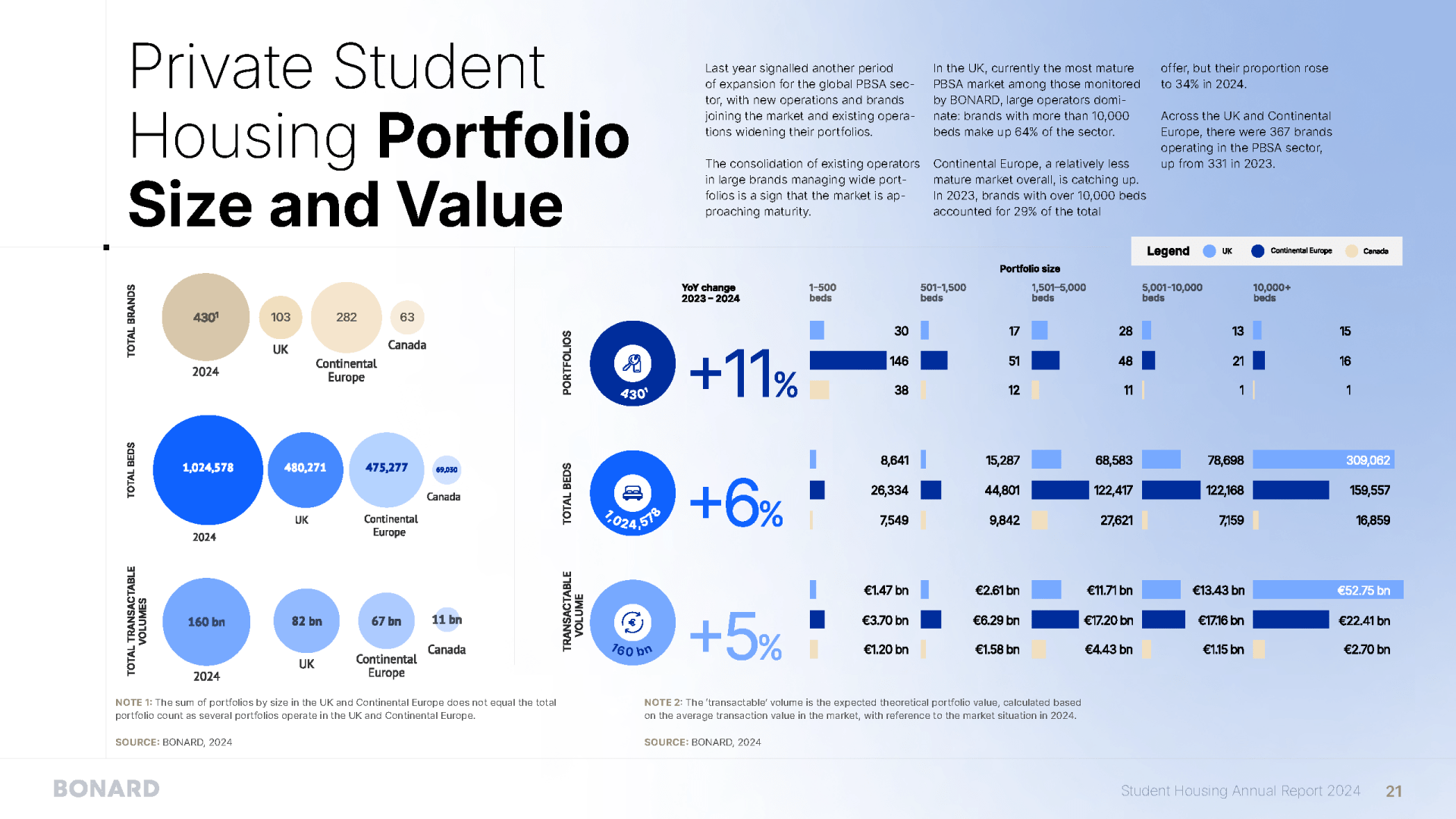

This expanding ecosystem of investors, developers, and operators is driving the creation of sizeable student housing portfolios. The growing number of active players enables more structured and scalable investments, fostering larger transactions and more sophisticated product offerings. “As a result, investors can now access bundled student housing assets, further enhancing liquidity and market efficiency,” says Stefan Kolibar, Chief Partnerships Officer at BONARD.

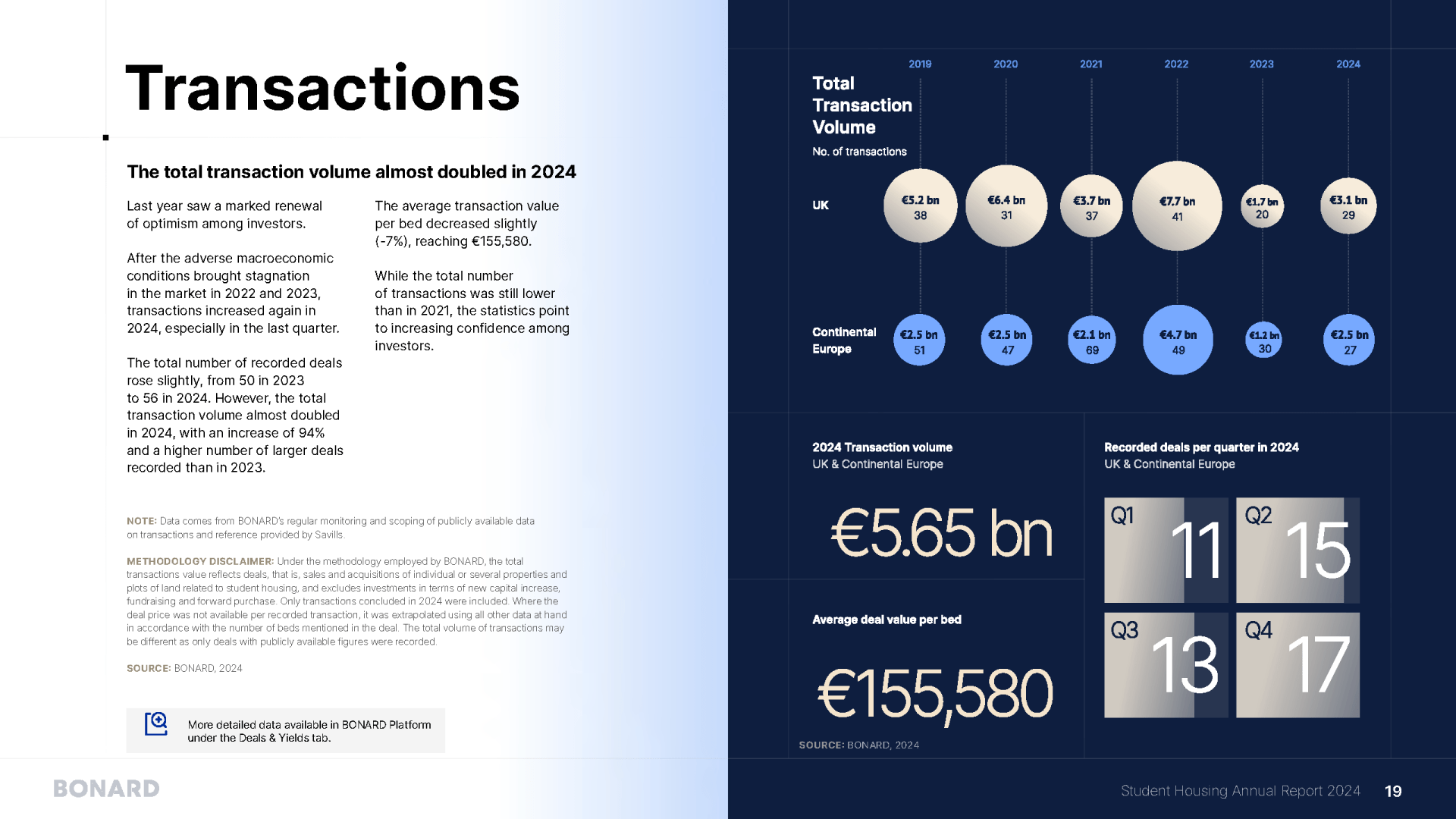

At present, data from the BONARD Platform shows that the European and Canadian student housing markets collectively comprise 431 portfolios. “Based on dozens of conversations we’ve had at MIPIM this week, it is clear that the rented living sectors, including student housing, are high on the investment radar. The incremental involvement of institutional investors and core capital is expected,” adds Kolibar. After stagnation in 2023, the volume of student housing transactions doubled in 2024, with a particularly strong uptick in the last quarter.

⠀

Source: BONARD Student Housing Annual Report 2024.

According to the latest data, rents recorded a 7.4% average increase across the 953 buildings monitored by BONARD. The UK saw a particularly impressive increase, with rents growing by 11.3%. In Continental Europe, where the average rent increase was 5%, Denmark and Portugal recorded the steepest rises at 7.8% and 8.4%, respectively. Despite these steep rent increases, occupancy rates remain high, averaging 97% across all the countries surveyed.

Most importantly, the total transaction volume in 2024 rebounded significantly, doubling compared to the previous year. “A particularly strong uptick in the last quarter indicates renewed confidence among investors, with an improved economic outlook expected to drive further growth in 2025,” adds Kolibar.

⠀

Source: BONARD Student Housing Annual Report 2024.

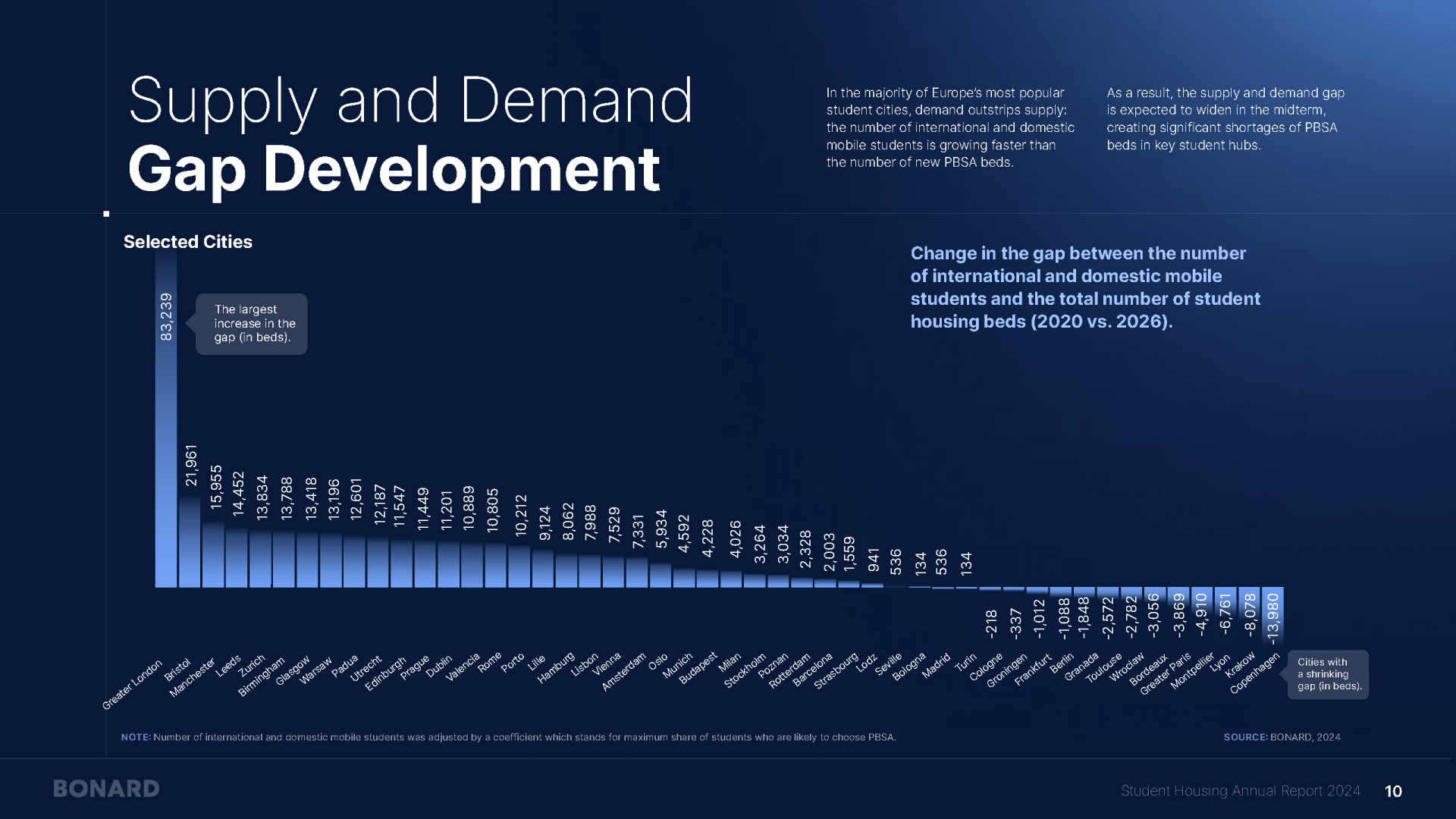

The latest statistics also confirm one of the sector’s key fundamentals: a significant supply and demand gap. The supply of student housing continues to struggle to meet demand, with 27% of student cities experiencing declining provision rates (the number of PBSA beds available versus the number of international and mobile students).

In a recent investor survey conducted by BONARD, responses gathered from 117 sector stakeholders revealed that over 70% of respondents plan to invest more in student housing in 2025 compared to 2024. This supports the prediction that the sector is set to benefit substantially from the improved economic outlook.

“Based on our historical data, we do not expect international student demand to drop, and the student housing sector has strong fundamentals that will enable it to thrive despite the uncertainty caused by regulatory changes in specific study destinations,” Kolibar concludes.

Source: BONARD Student Housing Annual Report 2024.

Source: BONARD Student Housing Annual Report 2024. Source: BONARD Student Housing Annual Report 2024.

Source: BONARD Student Housing Annual Report 2024. Source: BONARD Student Housing Annual Report 2024.

Source: BONARD Student Housing Annual Report 2024.