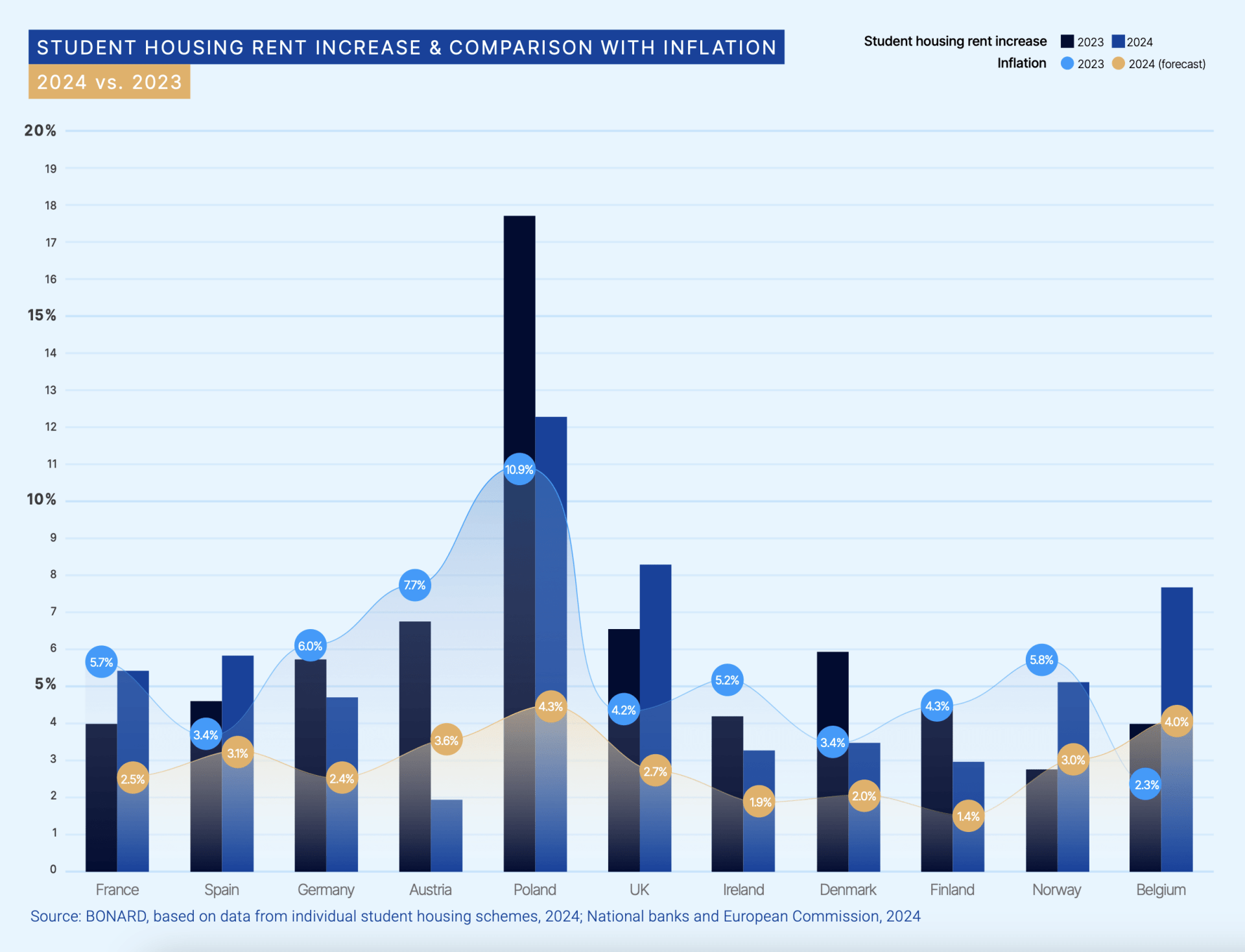

The Rent Research 2024 report by student housing research company Bonard, based on a survey of more than 1,200 PBSA establishments and market monitoring in 15 European countries, shows an average rental increase of 5.4 per cent, slightly lower than the 6.5 per cent average rise in last year’s research.

While the overall rate of increase was lower than 2023, some major study destinations, including the UK, France and Spain, saw rates increase at a higher rate this year.

Poland had the highest year-on-year increase in PBSA rents in the 2024 research at 12.3 per cent – well above the anticipated inflation rate for the year of 4.3 per cent in the country, followed by the UK (8.3 per cent increase in rents), Belgium (7.8) and Spain (5.9).

PBSA rent increases and inflation in the last two years. Graphic source - Bonard.

And in 10 out of the 15 European countries analysed, PBSA increases in 2024 were higher than the forecasted rate of inflation.

The authors predicted that PBSA rent increases will continue at a similar rate over coming years due to strong demand, high levels of occupancy and undersupply.

Occupancy rates have increased to almost full across all countries surveyed over the last last four years. Even during the Covid-19 pandemic, the PBSA sector performed well in terms of filling rooms with a 95.7 per cent occupancy rate in 2021, and this rose to 98 per cent in 2023, the authors said.

The UK has the highest rate of PBSA provision across Europe at around 40 per cent, but London would need around 180,000 additional beds to meet demand, the authors estimate.

Other major study cities with severe PBSA shortages include Paris, which would need an additional 195,000 beds to meet student demand, as well as Warsaw (107,000 beds), Berlin (94,000), Lisbon (78,000), Vienna (75,000) and Rome (71,000).

“High and rising PBSA occupancy rates across the majority of European cities underscore strong student demand, which enables the market to comfortably accommodate an average rental growth of five-to-eight per cent,” said Martin Varga, Real Estate Business Development Director at Bonard.

“The market is so severely undersupplied that occupancy rates are expected to rise even further. We don’t anticipate any decline in the current circumstances.”

The authors said, “A lack of quality accommodation creates a challenge for educational institutions, especially those located in student hotspots such as capital cities, and it can negatively impact their student recruitment ambitions. More investment is required to meet students’ needs in Europe.”

The findings echo a call for more investment and a diversification of portfolios to serve more price-conscious students by student housing sector platform The Class Foundation , following the release last week of its Student Living Monitor survey of higher education students across Europe.

Julia Oravec, Rented Residential Director at Bonard, said, “As European study destinations remain undersupplied, it is reasonable to expect that rents will keep growing steadily for the next three-to-five years."

“We expect rental growth to remain above inflation in the majority of countries, making student housing one of the most attractive investment opportunities on the market,” Martin added.

⠀

PBSA rent increases and inflation in the last two years. Graphic source - Bonard.

PBSA rent increases and inflation in the last two years. Graphic source - Bonard.