The Student Housing Annual Report 2024 by student accommodation research company Bonard is based on analysis of student housing assets in Europe and the UK, as well as additional research on Canada and Australia.

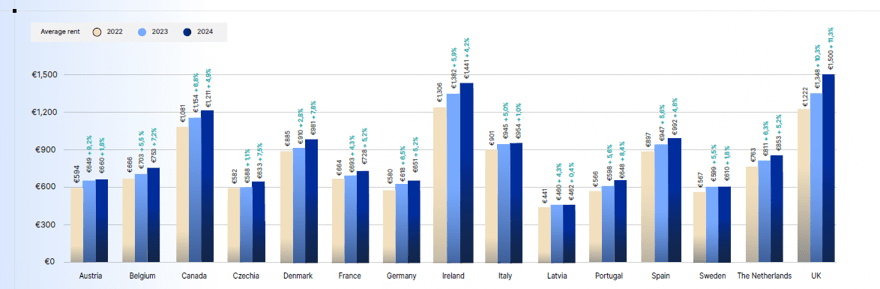

Rent increases: The average rent for a single studio in a private PBSA increased by 7.4 per cent across the assets analysed, up from 7.0 per cent in the previous year and the largest year-on-year increase since 2018, the authors said.

The UK had the highest yearly increase of rents at 11.3 per cent, followed by Portugal (8.4), Denmark (7.8) and Czechia (7.2), while rents in most of the major European study destinations increased by around five per cent.

Rent patterns across selected destinations. Graphic source - Bonard.

PBSA provision rates: Overall, the UK has by far the largest PBSA stock of the markets analysed with 589,971 beds in private and public PBSA, followed by France (242,822), Germany (234,707), Canada (178,662) and the Netherlands (123,063).

However, provision rates (calculated as total beds vs total number of university students) declined in 27 per cent of the 186 cities surveyed in 2024 and increased in 24 per cent. By 2026, provision is expected to increase in 30 per cent of those cities, but only by a small margin, the authors said, leaving the market under supplied.

Cities including Copenhagen, Cardiff, Leeds and Lund have a ratio of three students for each PBSA beds, while Amsterdam, Birmingham, Bristol, Edinburgh and Marseille have four students per bed.

The most undersupplied major cities with a ratio of at least 11 students per bed include Barcelona, Lisbon, Madrid, Milan, Rome and Sydney, the authors said.

Between 2020 and 2026, based on projections, the gap between the number of mobile students (domestic and international) and PBSA bed supply will increase most in London, by 83,299 beds, followed by Bristol (21,961), Manchester (15,955) and Leeds (14,452). Cities where the gap is expected to decrease in that period include Copenhagen, Krakow, Montpellier, Paris and Berlin.

New stock: A total of 230 PBSA buildings opened in 2024, adding 64,749 new beds across 131 student cities, according to the analysis, and Nottingham and Paris had the highest number of new beds delivered.

Vienna (+1,350 beds) and Copenhagen (+977) had the largest year-on-year increase in new beds delivered over the previous year, while Paris (-2,267), Amsterdam (-1,632) and Dublin (-1,609) delivered less than 2023.

Across 323 cities surveyed, there were 415,700 student beds in the pipeline, which represents a 20 per cent increase over the end of 2023. London has the highest number either in planning or construction (35,773), followed by Paris (14,790) and Manchester (12,691).

Contract lengths: Looking at contract lengths, the authors found that more than 17 per cent of residences are now offering 13-to-24-month contracts, up from 13 per cent in the previous year, while 13 per cent are offering 25 month+ contracts, up from only two per cent previously.

Within Europe there was a 16 per cent increase in residences offering short-term 1-to-3-month contracts, and an 11 per cent rise in those offering 4-to-6 month arrangements.

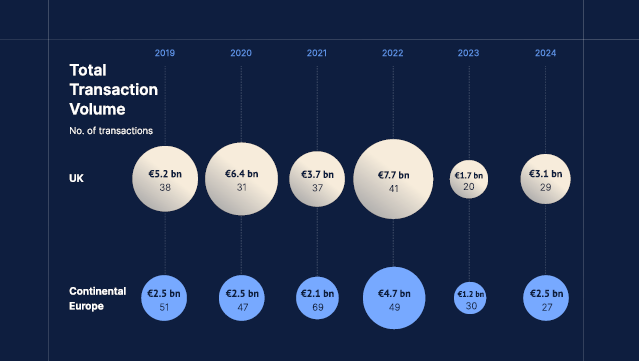

The pattern of PBSA transaction volumes in the UK and Europe. Source - Bonard.

Occupancy: The average occupancy rate across all of the PBSA assets analysed was 97 per cent in 2024, although there were very slight declines in occupancy rates in the UK (96), Italy (95), Germany (96) and Austria (93), which may have been caused by rising rents and longer student visa approval times, the authors said.

Transactions/investment: The value of PBSA transactions by investors in the UK and Europe reached €5.65 billion in 2024, a 94 per cent increase over the previous year.

A survey of 112 PBSA investors revealed that 54.8 per cent expect investment volumes on PBSA to increase moderately in 2025, while 25.8 per cent anticipate investment volumes growing considerably.

Portfolios: Across the UK and Europe, there were 367 brands operating in the PBSA sector in 2024, up from 331 in the previous year.

Unite Students remains the largest portfolio in the PBSA sector with 75,637 beds, followed by iQ Student Accommodation (38,800), UPP (35,506), YUGO (27,936) and Homes For Students (26,633).

The latter had significant year-on-year growth in beds in 2024 at 23.4 per cent, while aparto Student has the largest pipeline of the emerging brands, the authors said, with a 82.3 per cent increase over 2023 last year.

Click hereto access the full report.

⠀

Rent patterns across selected destinations. Graphic source - Bonard.

Rent patterns across selected destinations. Graphic source - Bonard. The pattern of PBSA transaction volumes in the UK and Europe. Source - Bonard.

The pattern of PBSA transaction volumes in the UK and Europe. Source - Bonard.