Investment in the real estate sector is gathering pace, and one particular asset class is set to attract the lion’s share of attention: student housing.

The Purpose-Built Student Accommodation (PBSA) sector proved itself during the Covid crisis and the ensuing macroeconomic turbulence when it performed better than other real estate asset classes.

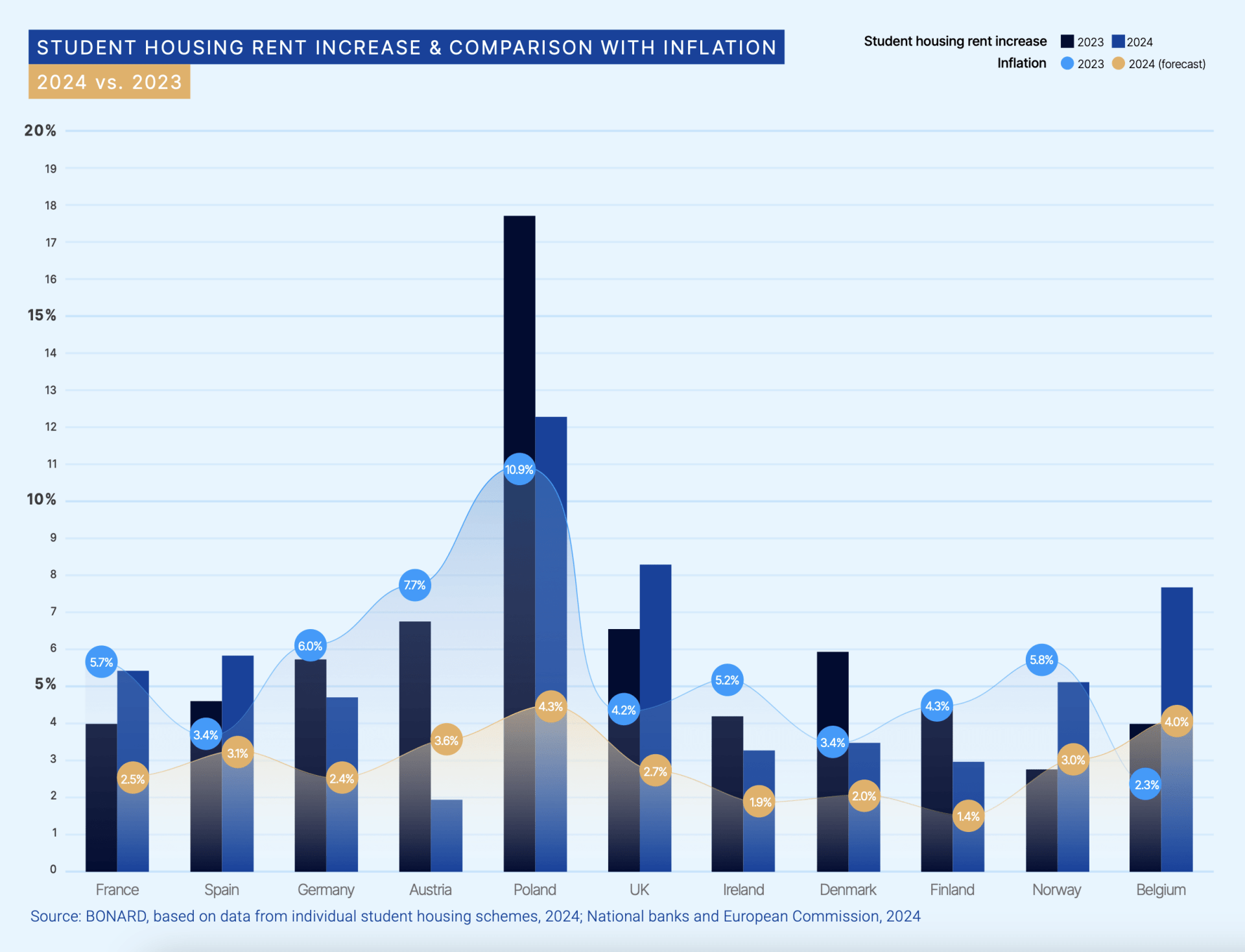

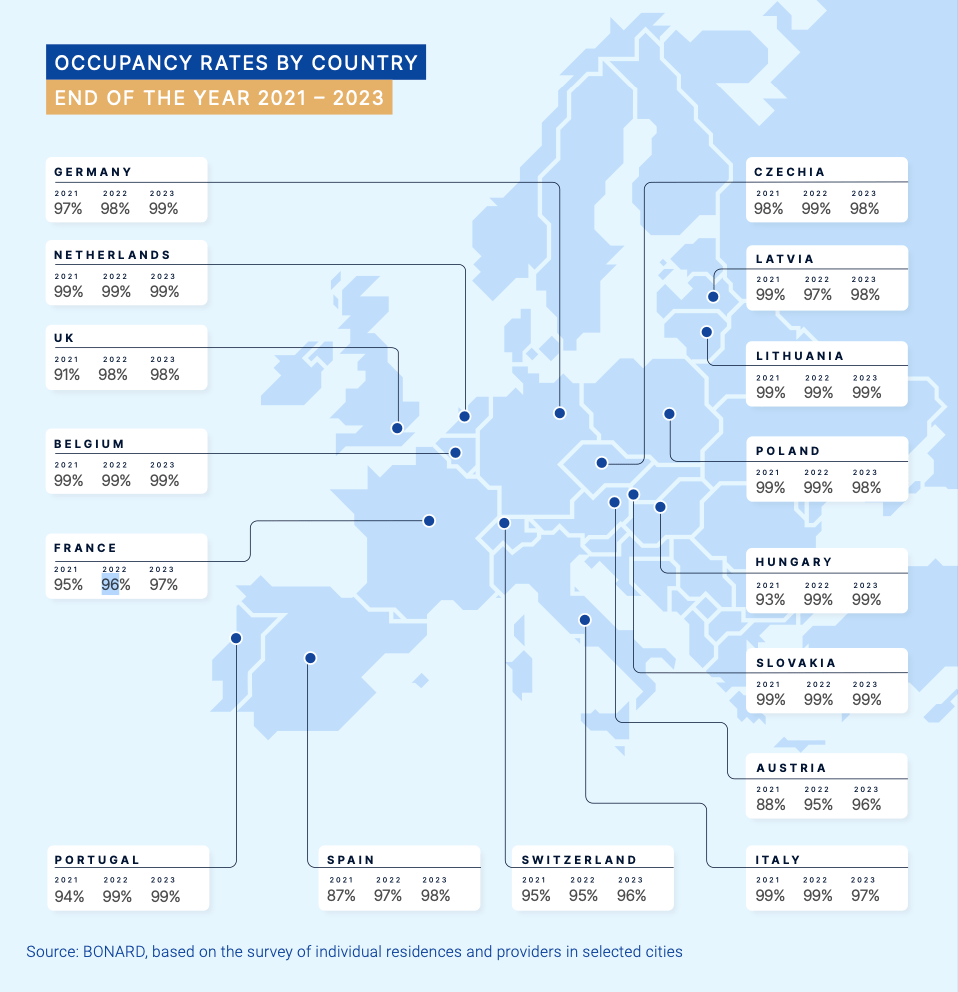

As demand for student housing solutions grew unabated even during the crisis, the sector saw rents rise faster than inflation in several (10 of 15) countries, while occupancies increased at the same time (mostly 95–98%).

Given these strong fundamentals, PBSA will be an even more profitable investment opportunity now that interest rates and inflation are projected to fall.

The sector is severely undersupplied: even in traditional study destinations with a well-developed PBSA sector, tens of thousands of new beds will barely meet existing student demand.

As a relatively young sector, student housing can also offer the best rewards to investors who enter the market early.

Samuel Vetrak, CEO of market data and advisory firm BONARD, reports that investors’ interest in student housing is clearly rising, with growing demand for data to support strategic decisions.

“We are observing more and more investors moving from traditional real estate asset classes to student housing. We are also receiving more data requests than ever,” Vetrak comments.

With a team of 80 researchers and real estate experts, BONARD is the leading provider of data and market intelligence for the student housing sector.

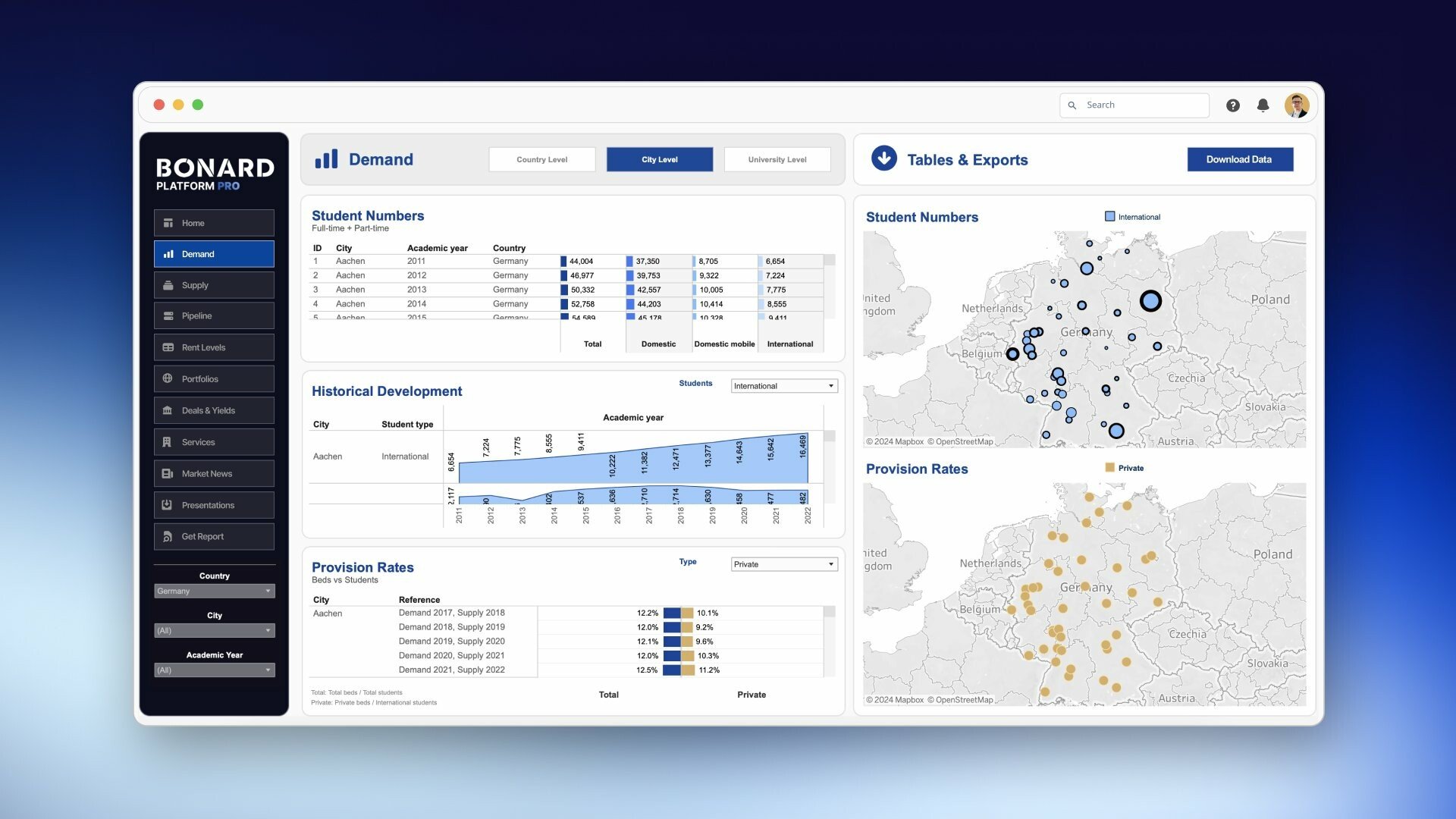

Its flagship service, the BONARD Platform, provides access to granular, time-series data on key performance indicators (KPIs) in the global student housing sector, covering more than 14,000 assets in over 260 markets.

“Investors require data on several KPIs to inform investment strategies and transactions; high levels of interest in our data signal that investment and transactions are set to increase,” Vetrak explains.

The Platform is curated and regularly updated by BONARD’s team of researchers. The latest update includes asset-level data for granular benchmarking, portfolio information on the leading investors and operators in the student housing space, and a complete overview of yields in the PBSA and other real estate sectors.

Responding to market feedback and increased traffic, the BONARD Platform now features a new design and an enhanced interface that enables users to effortlessly consult and work with all the data in its extensive database. Data can be seamlessly benchmarked, analysed and compared across markets, cities and assets.

“Any sector needs transparency to thrive. Access to transparent information is the first step to attract investment and allow the student housing sector to reach its full potential,” Vetrak concludes.

“By providing access to market intelligence and data, we strive to support the sector’s success.”

The BONARD Platform provides information about KPIs including rent levels, demand, occupancy rates, transactions, yelds in PBSA and other real estate sectors, planning, development and construction pipelines, provision rates, asset-level information, including amenities on offer, and portfolios.

All data is directly comparable, as the same methodology is used for collection and analysis across all markets and different years.

⠀