Demand for student housing among investors across Europe continues, and for good reason, as it has proved to be a resilient as well as counter-cyclical sector.

AEW’s recent report, European Residential: Finding a New Balance, describes PBSA (purpose-built student accommodation) as a growth sector, as investment transaction volumes are expected to rebound this year and for years to come. The UK and Southern European markets are highlighted as being the most promising.

“Student housing is a counter-cyclical market where the demand fundamentals are strong, and yields have proved to be more resilient to the rise in interest rates than prime residential and other sectors,” said Hans Vrensen, head of research and strategy Europe at AEW.

PBSA has been particularly resilient during downturns, because student numbers increase as people choose to upskill or stay in education. This, coupled with attractive returns, reinforces investors’ attraction to the sector, the report says.

Investor appetite has been growing in the past few years. Student housing accounted for more than 5% of total property investment volumes in Europe in 2022, up from 1% in 2011. Record transaction volumes of €15.6 billion were also recorded in 2022, reflecting the sector’s increasing maturity and liquidity.

Last year, in difficult market conditions, European student housing volumes declined to €4.9 billion, as prices adjusted to higher interest rates. Investors’ interest in the sector, however, appears to be undimmed: according to INREV’s 2024 Investment Intentions Survey, student housing recorded the biggest increase in terms of investment preference.

The importance of foreign students

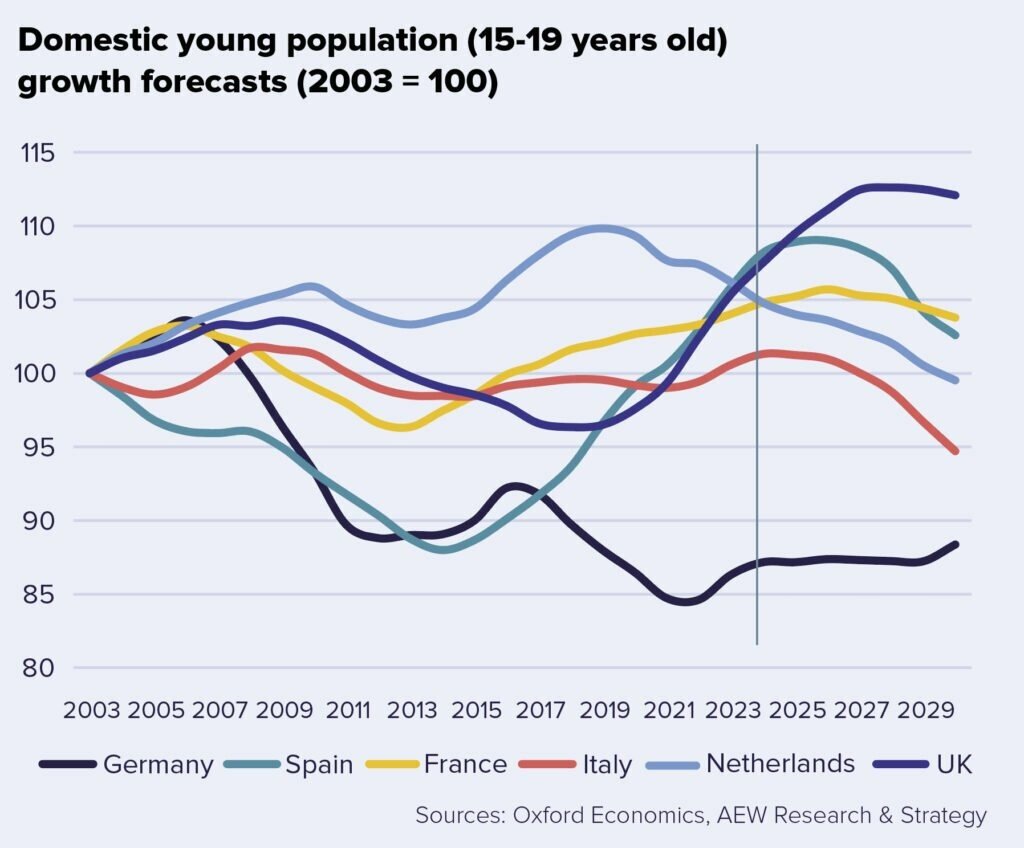

As the population is ageing across Europe, the PBSA sector faces a demographic challenge: domestic students are expected to decrease in most countries. The downward trend is most acute in Italy, Spain and Netherlands, where fertility rates have been decreasing.

The student-age population is expected to remain stable in Germany and in France, while the UK stands out as the country with the best demographic outlook, where the strongest increase in the young population is expected.

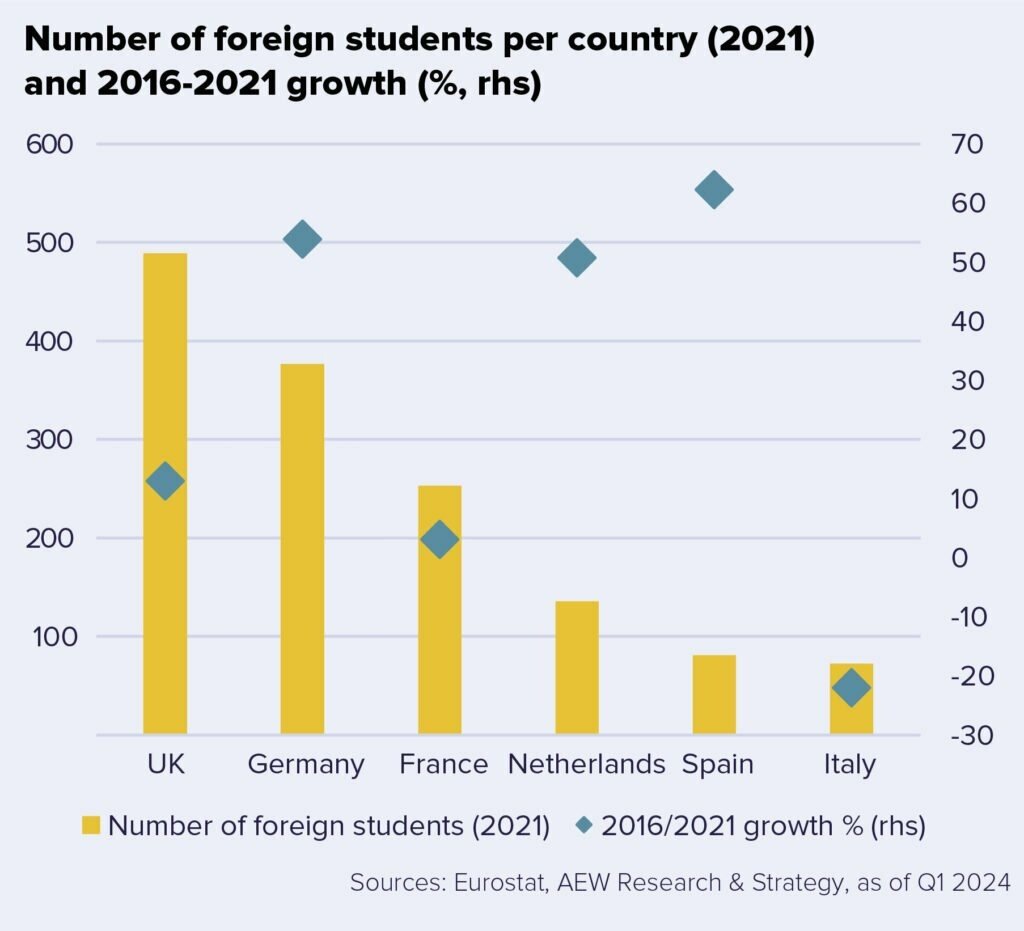

However, the report points out that the mixed demographic story is partly offset by the increasing number of foreign students choosing to attend university courses in European countries. Germany, the UK and France attract the highest number of students from abroad.

The number of foreign students has increased by more than 50% in Spain, Germany and the Netherlands since 2016, driven by the growing number of English-speaking programmes on offer. The increase has been much more limited in the UK (+13%) and in France (+3%).

Italy has gone into reverse, with the number of foreign students falling by 22% in 2021, but this is linked to the more restrictive measures adopted by the Italian government during the Covid-19 pandemic. More recent data, when available, is expected to be in line with the Continent-wide upward trend.

Foreign students are less likely to rent in the private rental sector because of the complexities associated with lease contracts with private landlords. PBSA provides a simpler, easier alternative, with all-inclusive contracts that typically include utilities, an internet connection, access to onsite services and amenities, and the opportunity to be part of a student community and make friends.

Southern Europe lags behind

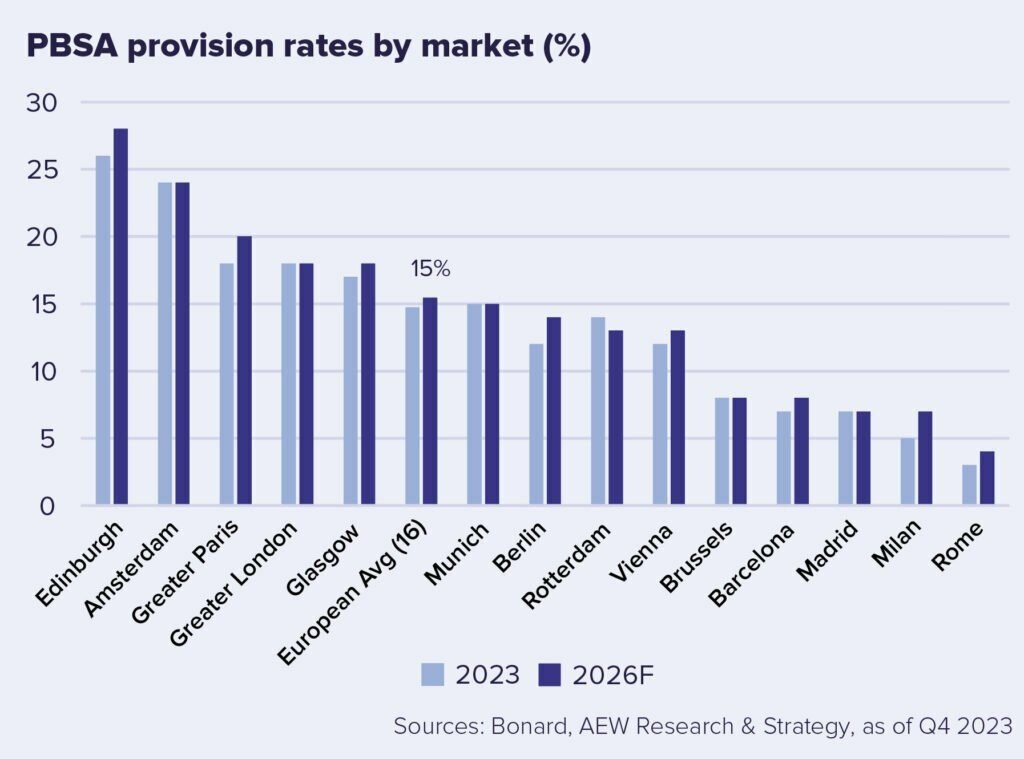

On average, 85% of students in European universities live at home or in private rental accommodation. The average PBSA provision rate in Europe is 15%, calculated as the ratio between the number of beds available and the total number of full-time students in the market, but percentages vary hugely from country to country.

Northern European countries have a more mature PBSA sector, with high provision rates, especially in Copenhagen (28%), Edinburgh (26%) and Amsterdam (24%).

By contrast, cities in Southern Europe have lower provision rates, which means there is plenty of room for growth in PBSA stock. Rome, for example, has a provision rate of 3%, Milan 5%, while Madrid and Barcelona are at 7%.

Southern European markets like Milan and Madrid have higher student housing yields, in line with other less liquid Eurozone alternative property markets. The excess yields spread is likely to decrease in the coming years as operators expand into Spain and Italy and the sector matures.

In the past 10 years, PBSA yields have been compressing significantly as the sector has become more sought-after by institutional investors. Prime student housing yields remain higher than prime residential yields, by 100bps on average, to reflect operational risks.

Student housing yields are currently 5.3% on average in Europe’s 10 main markets, after decompressing by 120bps in 2022 and 2023, in line with prime residential yields. AEW’s prediction is that student housing yields will move from 5.3% to 5% by the end of 2026.

Provision rates are expected to increase everywhere in Europe between now and 2026, according to forecasts by Bonard, as European student housing operators have woken up to the opportunity and are expanding to meet increasing demand.

UK retains number-one spot

The UK remains by far the most liquid investment market, representing 60% of European volumes in 2023, which is in line with the historical average. France is the second largest market, accounting for 16% of European volumes.

Rising numbers of international students are behind growing demand for UK PBSA. Demand exceeded 1.7 million in 2021/22, up 20% from pre-pandemic figures. Demand continues to exceed supply, as only 20,000 beds were added in 2022/23 to the 745,000 available.

Obstacles to creating new supply are many and varied, from issues around planning permits to tougher safety and energy efficiency regulations, and from the higher cost of materials and construction to steep financing costs because of high interest rates.

“This emphasises a structural supply imbalance,” AEW’s report points out. “The negative Brexit effects on EU student mobility were more than offset by the growth of student numbers from China and India.”

While new supply has failed to keep up with demand in the UK, the traditional alternative to PBSA has also become less available. Multiple occupation housing and flat sharing has declined as a result of rising interest rates, high taxation and licensing restrictions on owners. This, the report underlines, “creates a further opportunity for PBSA”.

UK investment volumes show a similar pattern to Europe: they reached a record high in 2022, at more than £7 billion, which mostly comprised portfolio deals. Last year, volumes declined by 60% to just £2.8 billion, making 2023 the worst year for the sector since 2018.

The drop is due to the Bank of England’s steep increases in interest rates from 1.75% to 5.25% in just a year. The higher cost of debt, limited availability of financing, and uncertainty over pricing had a dampening effect on market activity.

Forward funding deals

However, strong demand for PBSA assets was evident in 2023 as forward funding deals reached their highest level since 2016, despite elevated debt and construction costs.

Therefore, the report concludes, “as a result of the ongoing demand-supply imbalance and continuing yield premium, we would expect investment transaction volumes to rebound in 2024 and beyond”.

PBSA yields have softened in the UK as a consequence of the macroeconomic situation, and Central London yields have continued to shift out further in 2023 by 50bps, increasing to 4.25% in February of this year. “Given its ultra-low yields, pricing in London has been more impacted by the higher interest rates environment,” the report says.

Yet regional yields have remained stable throughout 2023 and into 2024. Transaction data is limited, but the report argues that these markets are supported by their stronger rental growth and more acute supply shortages.

“This regional yield stability confirms the confidence in the sector and its long-term income prospects,” AEW says. “Based on our analyses, we project that UK regional university towns and Southern European student housing markets are the most attractive for investment over the next five years,” said Vrensen.

⠀