Julia Oravec, Rented Residential director at Bonard, explained: "As European study destinations remain undersupplied, it is reasonable to expect that rents will keep growing steadily for the next 3-5 years. Occupancy rates are also projected to rise even further.’

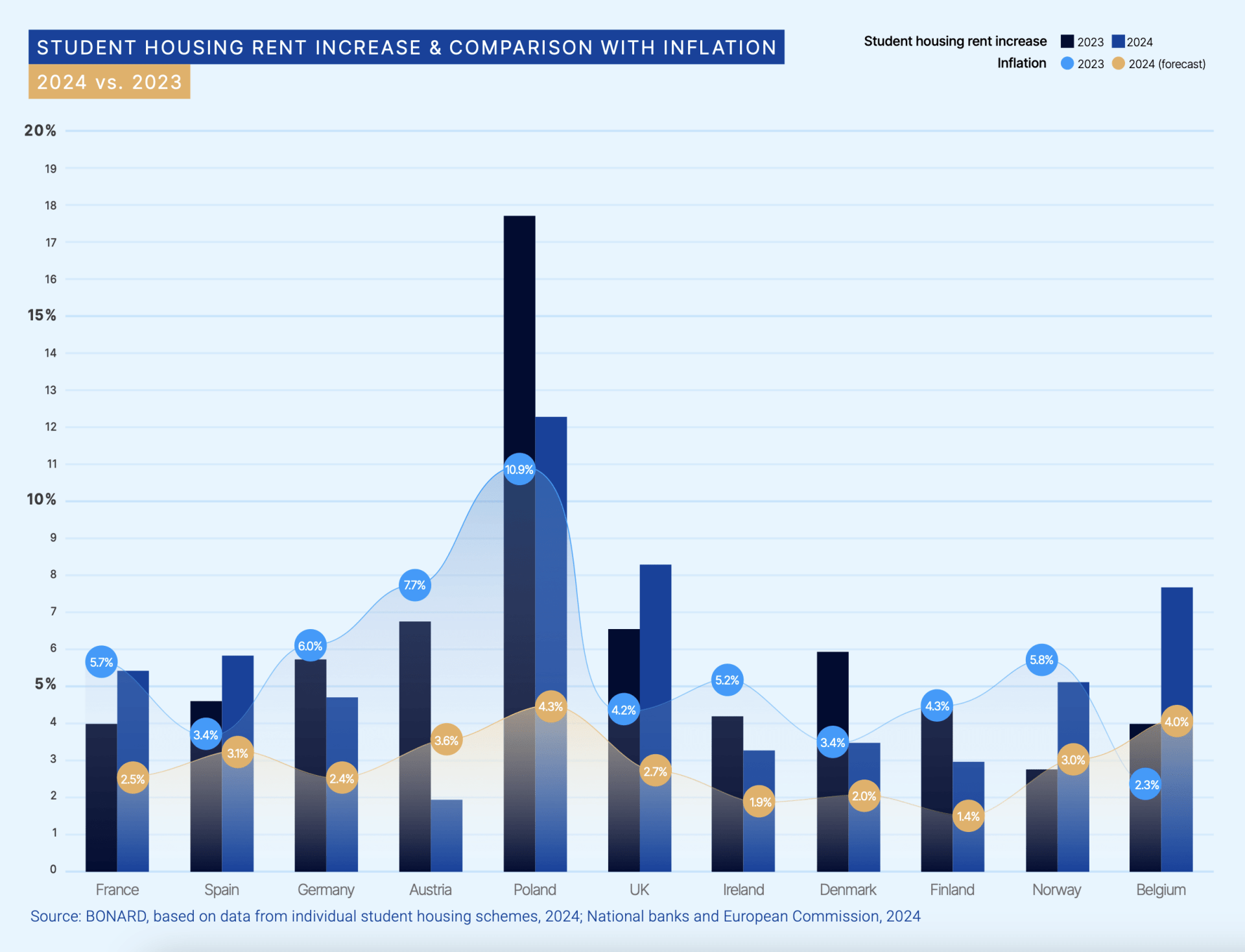

Rents in the European student housing sector have continued to rise at a faster pace than pre-pandemic levels, increasing by 6.5% in 2023 and a further 5.4% in 2024. In three of the surveyed countries (France, Spain, and the UK), rental growth is still accelerating.

This rental growth is projected to significantly outpace inflation rates in 10 out of the 15 countries surveyed in the coming 6-12 months. Poland stands out, with rents increasing by 12% compared to a forecasted inflation rate of 4.3%.

Despite the rising rents, demand for student housing remains strong, with PBSA operators reporting a 98% average occupancy rate in 2024.

According to Martin Varga, Bonard's Real Estate Business Development Director, the robust student demand allows the market to comfortably absorb rental growth of 5-8%. ‘Demand for PBSA has been steadily growing over the past decade, except for a slight decrease during the pandemic crisis, and all signs point to ongoing growth," Varga added. "Not only are student numbers rising, but student preferences are also becoming more sophisticated. We observe a growing interest in quality PBSA options with a range of additional services and amenities.’

Occupancy rates have increased from 95.7% in 2021 to 98% in 2023, with Spain (+11%), Austria (+8%), and the UK (+7%) experiencing the highest growth.

Provision rates remain low across the European PBSA market. The UK, the most developed market, has a provision rate of only 40%. Germany and France hover around 20%, Spain at 16%, and Italy at only 10%.

Accommodation shortages have been reported in most major European student destinations. Key cities like London and Paris would require an additional 180,000 and 195,000 beds respectively to meet the current demand from students. Cities like Warsaw (107,000 beds), Lisbon (78,000), Vienna (75,000), and Rome (71,000) face particularly acute shortages of student accommodation. However, this situation is generally consistent across all 15 cities surveyed.

Given these conditions, which are unlikely to change soon, the student housing sector presents a particularly attractive investment opportunity, according to Bonard.

The Bonard report surveyed 12,000 PBSA operations in 15 European cities.

⠀